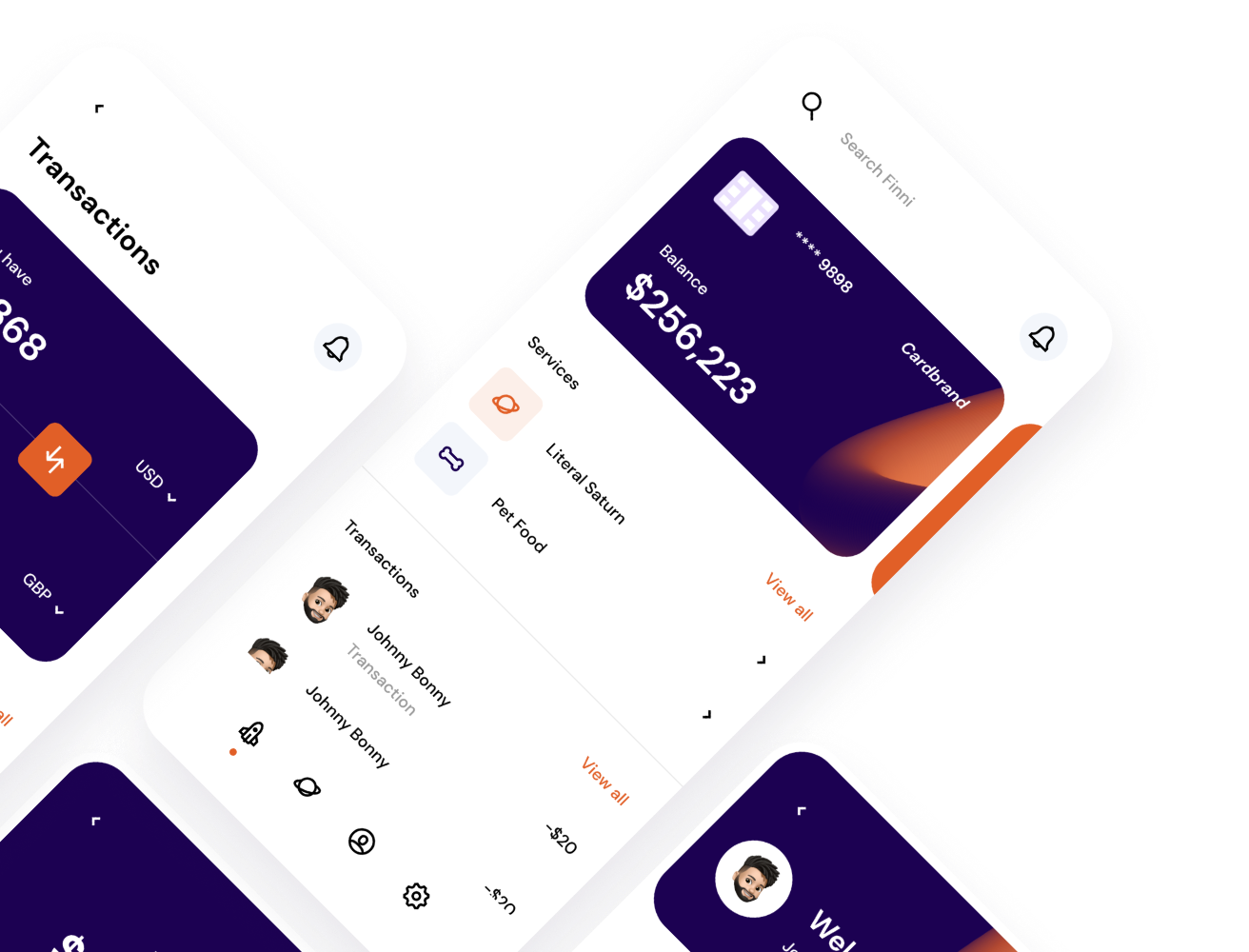

Launch physical and virtual card strategies quickly and easily with authorization models that work for you and your business.

Free-up operating capital with JIT funding for your cards that do away with the need to pre-fund transactions.

Most online websites require payment cards to be 3D secure. Our cards are enrolled for 3D security so card holders can enjoy better acceptance.

Create a Spend Limit on each card to block hidden fees and double charges on recurring expenses.

Cardholders can load virtual and physical cards into their digital wallets to enable instant and secure access to funds, however they they choose to pay—online, in-app, or in-store.

We Serve individuals and businesses( Limited to Expense management solutions and Payroll solutions ) Only.

Ontop of our seamless card issuing platform, you enjoy free and cheap transfers and the lowest cross-border rates. More money stays in your pocket, and more arrives in theirs.